DIGITAL ADVERTISING LIBRARY

Our display advertising delivers strong results you can trust – outperforming industry standards for viewability and brand safety.

Features & Benefits

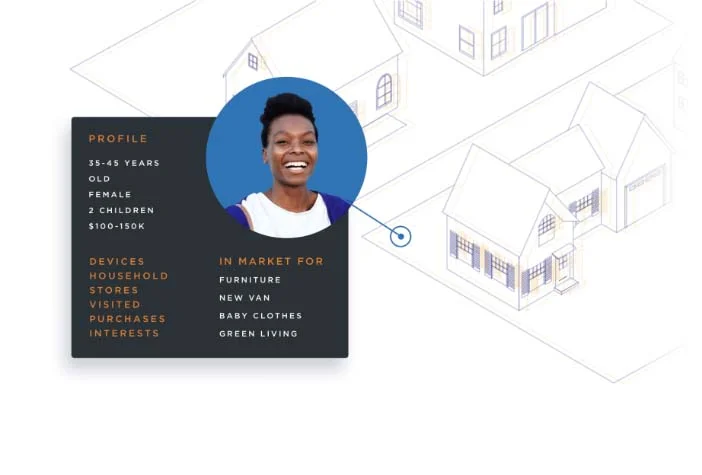

- Target the Most Receptive Consumers

Find people ready to act by uniting consumer browsing and buying behaviors with their home and the places they go using the Vericast Consumer Graph™.

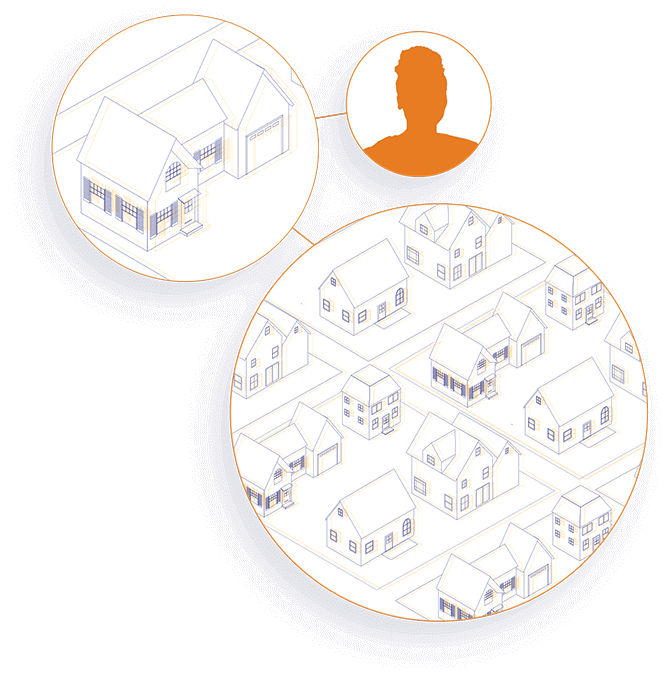

- Balance Precision and Scale

Gain targeting flexibility with the power to precisely reach individuals and scale to Digital Zip® solutions for increased performance with display advertising.

- Optimize Engagement

Take display advertising to the next level. Our dynamic creative offerings can help drive business results by showing more relevant products, nearest store locations and more.

- Trust Our Quality & Viewability

As certified leaders in brand safety and transparency, we consistently deliver impressions that surpass industry standards and are on average:

- 78.2% average display ad viewability

- 99.1% fraud-free impressions

- 99.6% brand-safe impressions

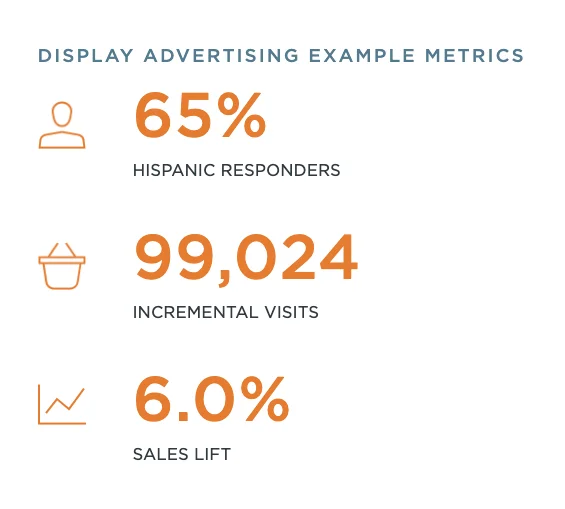

- Gain Actionable Insights

Measure against your defined KPIs with a wide range of audience insights and impact studies that are delivered in time to inform your next display advertising campaign.

You may also be interested in…